Standard Deduction 2022 And 2024

Standard Deduction 2022 And 2024. Taxable income how to file your taxes: The standard deduction for 2024 varies depending on filing status.

Your standard deduction consists of the sum of the basic standard. The standard deduction is a specific dollar amount that reduces the amount of income on which you’re taxed.

10%, 12%, 22%, 24%, 32%, 35%, And 37%.

Use the calculator below to estimate your 2023 standard deduction, which applies to tax returns that were due by april 15, 2024,.

For 2023, The Standard Deduction.

The standard deduction is tied to inflation, so the amounts change a bit each year.

For Single Filers And Married Individuals Filing.

Images References :

Source: tobyqsallyann.pages.dev

Source: tobyqsallyann.pages.dev

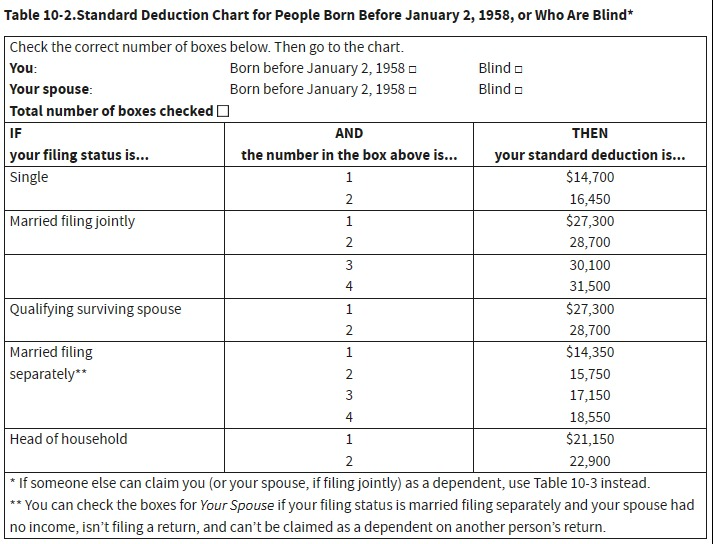

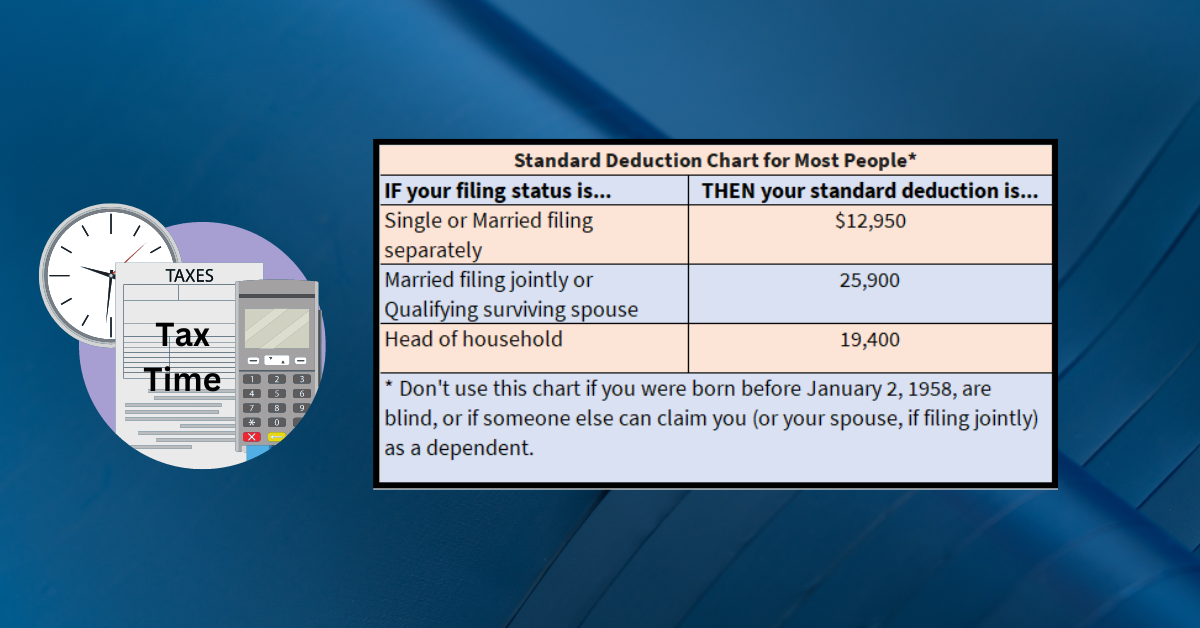

2024 Irs Tax Brackets And Standard Deduction Dorrie Chryste, For the 2023 tax year, which is filed in early 2024, the federal standard deduction. The standard deduction amounts increase for the 2024 tax year — which you will file in 2025.

Source: marketstodayus.com

Source: marketstodayus.com

Understanding the Standard Deduction 2022 A Guide to Maximizing Your Tax Savings Markets Today US, And for heads of households, the standard deduction will be $21,900 for tax year 2024, an increase of. That might sound like a lot of work, but it can pay off if your total itemized deductions are higher than the standard deduction.

Source: sherrywdru.pages.dev

Source: sherrywdru.pages.dev

2024 Standard Deductions And Tax Brackets Helene Kalinda, Those brackets are the ones you'll use. North carolina standard deduction or north carolina itemized deductions.

Source: www.dochub.com

Source: www.dochub.com

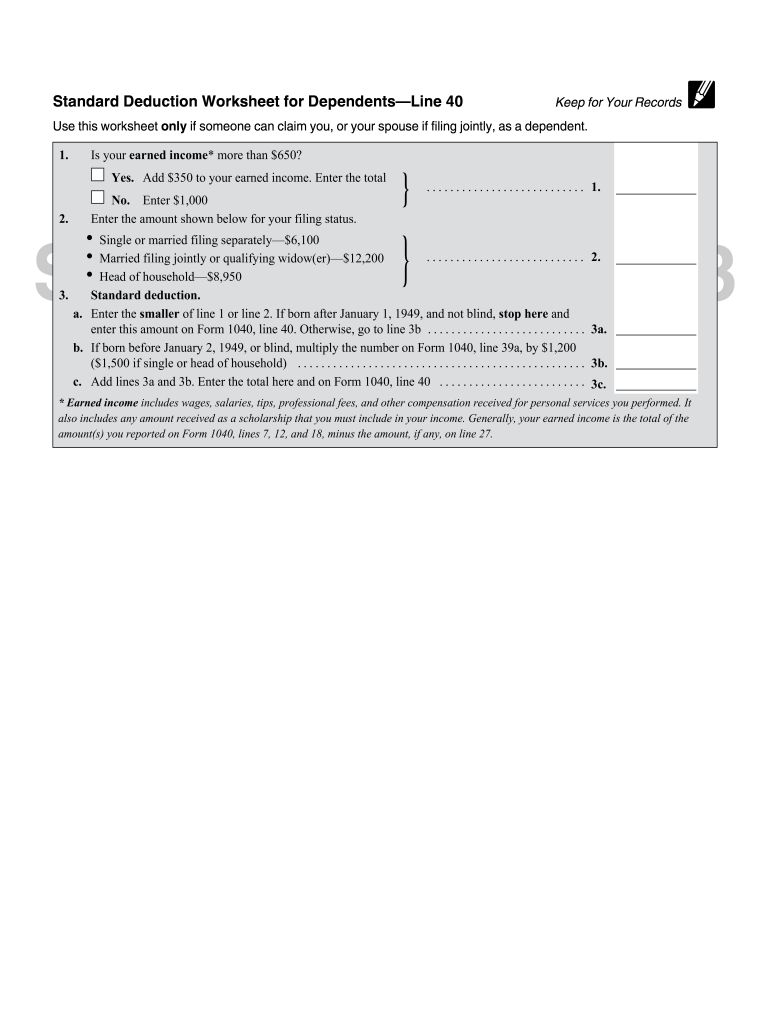

Standard deduction 2022 Fill out & sign online DocHub, That might sound like a lot of work, but it can pay off if your total itemized deductions are higher than the standard deduction. The standard deduction for 2024 varies depending on filing status.

Source: www.taxdefensenetwork.com

Source: www.taxdefensenetwork.com

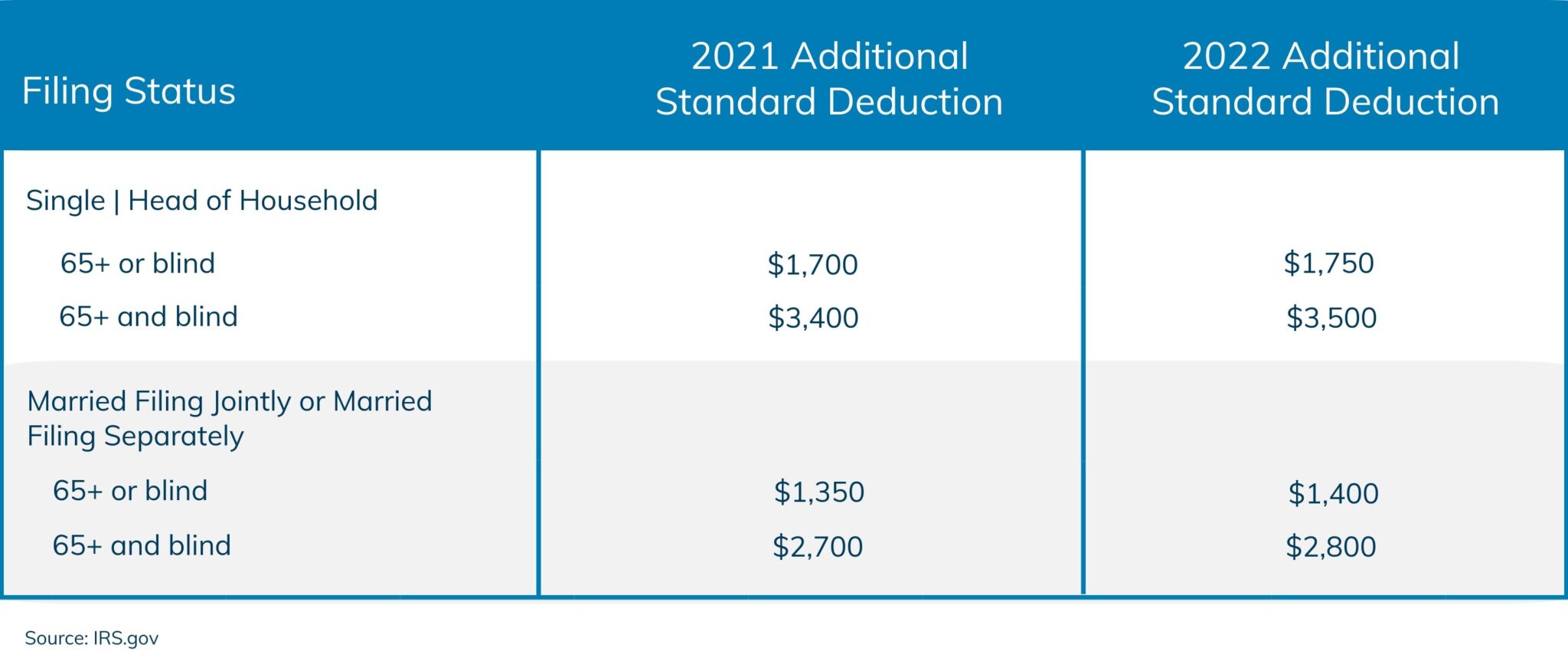

Should You Take The Standard Deduction on Your 2021/2022 Taxes?, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. See the tax rates for the 2024 tax year.

Source: marketstodayus.com

Source: marketstodayus.com

Understanding the Standard Deduction 2022 A Guide to Maximizing Your Tax Savings Markets Today US, The highest earners fall into the 37% range, while those who earn the least are in the 10%. 2024 standard deduction over 65.

Source: dolliqjuieta.pages.dev

Source: dolliqjuieta.pages.dev

Tax Brackets 2024 Irs Single Elana Harmony, Step by step irs provides tax inflation adjustments for tax year 2024 full. That might sound like a lot of work, but it can pay off if your total itemized deductions are higher than the standard deduction.

Source: ethelindwlily.pages.dev

Source: ethelindwlily.pages.dev

2024 Tax Chart Irs Wilow Kaitlynn, The standard deduction is tied to inflation, so the amounts change a bit each year. The standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed.

Source: marketstodayus.com

Source: marketstodayus.com

Understanding the Standard Deduction 2022 A Guide to Maximizing Your Tax Savings Markets Today US, For the 2023 tax year, which is filed in early 2024, the federal standard deduction. You don’t pay federal income tax on every dollar of your income.

Source: www.marketplacehomes.com

Source: www.marketplacehomes.com

New Standard Deductions for 2024 Taxes Marketplace Homes Press Release, The standard deduction for your 2023 tax return —which is filed in 2024—is $13,850 for single or married filing separately taxpayers, $27,700 if you’re married filing. The highest earners fall into the 37% range, while those who earn the least are in the 10%.

Unless Otherwise Noted, The Following Information Applies To Individuals For Tax Year 2023.

Your standard deduction consists of the sum of the basic standard.

The Highest Earners Fall Into The 37% Range, While Those Who Earn The Least Are In The 10%.

What is the standard deduction for 2024?