Pay Estimated Taxes Online 2024 Free

Pay Estimated Taxes Online 2024 Free

Calculate your upcoming quarterly tax payment, with this free tool for freelancers. Try keeper's free quarterly tax calculator to easily calculate your estimated payment for both state and federal taxes.

Our home sale calculator estimates how much money you will make selling your home. Paying your estimated taxes can be done through several methods:

Based On Your Projected Tax Withholding For The.

You can pay your estimated taxes online through your irs account, the irs2go app, irs direct pay, or the electronic federal tax payment system (eftps).

There Are Four Payment Due Dates In 2024 For Estimated Tax Payments:

Final payment due in january 2025.

Images References :

Source: www.youtube.com

Source: www.youtube.com

How to Pay Federal Estimated Taxes Online YouTube, You can pay your estimated taxes online through your irs account, the irs2go app, irs direct pay, or the electronic federal tax payment system (eftps). Enter your filing status, income, deductions and credits and we will estimate your total taxes.

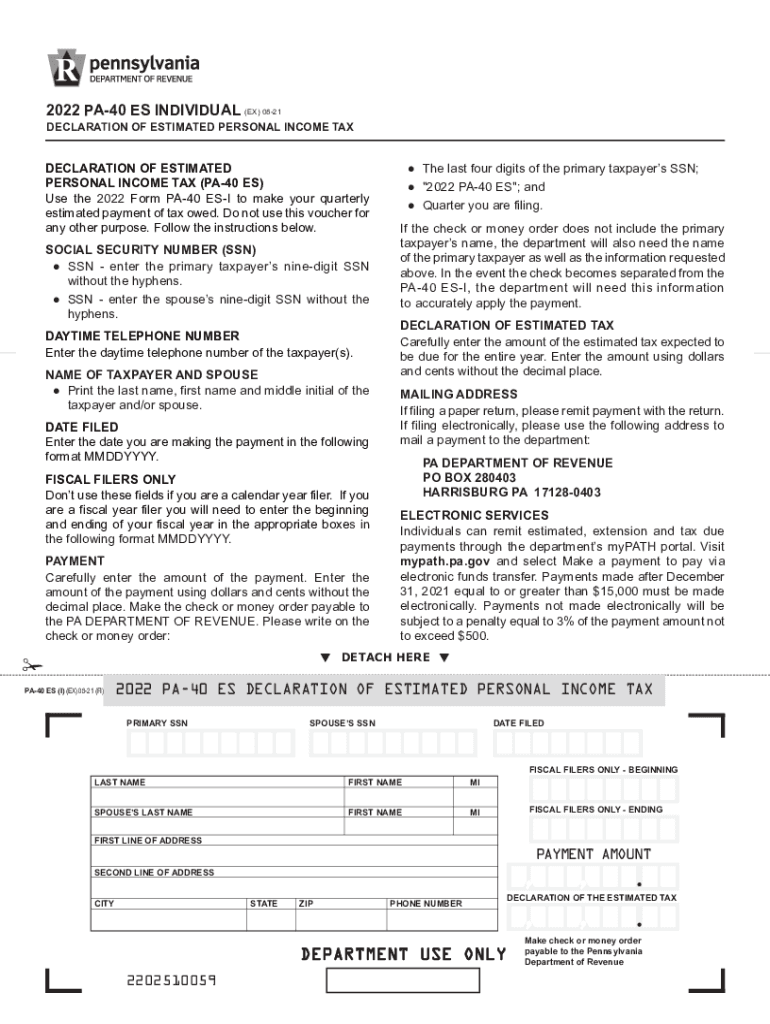

Source: www.signnow.com

Source: www.signnow.com

Pa 40 Es 20222024 Form Fill Out and Sign Printable PDF Template, Updated on apr 24 2024. You can pay your estimated taxes online through your irs account, the irs2go app, irs direct pay, or the electronic federal tax payment system (eftps).

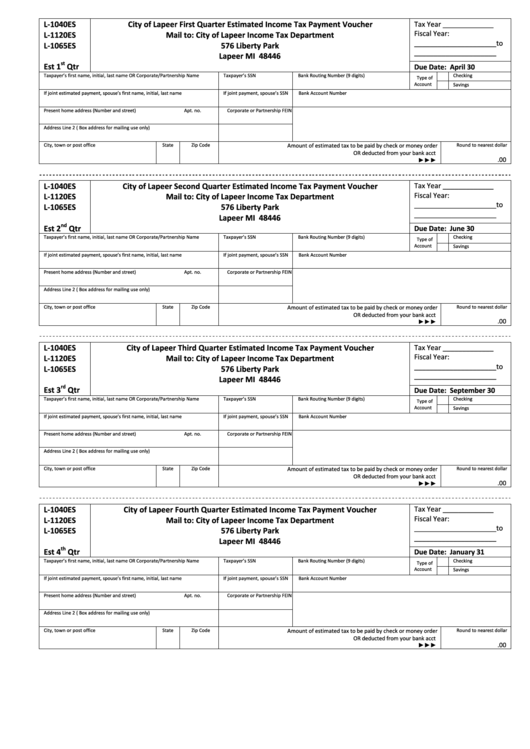

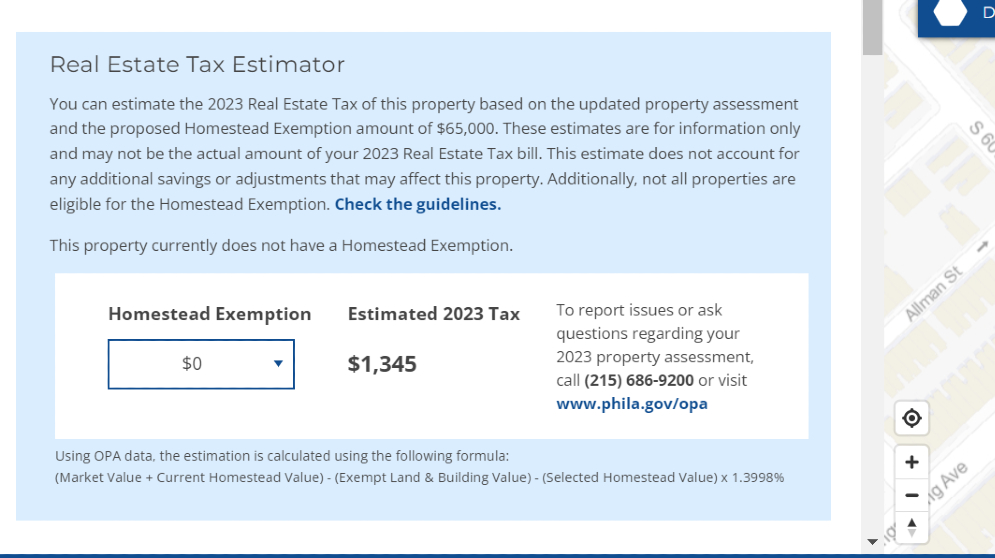

Source: philliewelayne.pages.dev

Source: philliewelayne.pages.dev

2024 4th Quarter Estimated Tax Payment Gabey Shelia, Reuters.com is your online source for the latest world news stories and current events, ensuring our readers up to date with any breaking news developments. There are four payment due dates in 2024 for estimated tax payments:

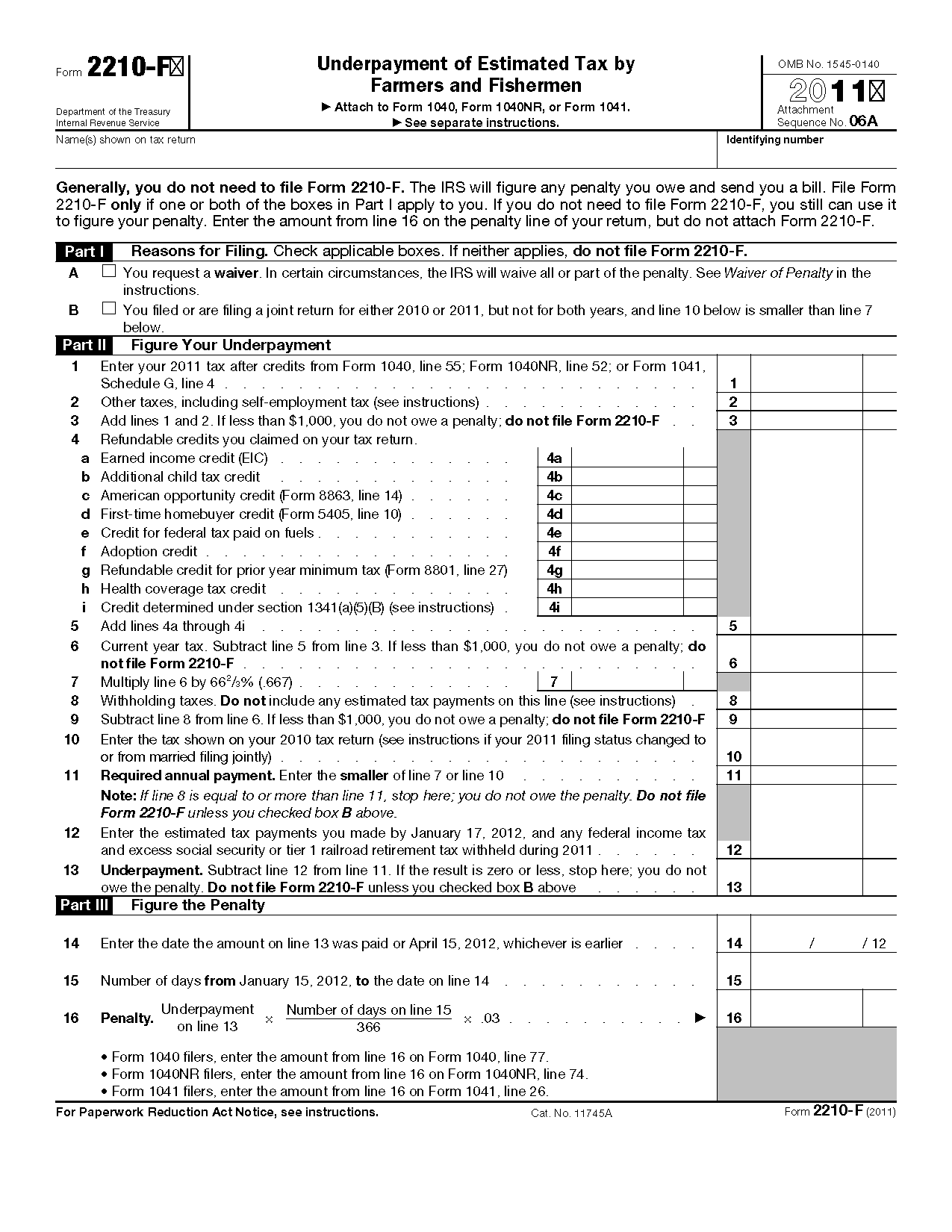

Source: www.signnow.com

Source: www.signnow.com

Where Do I Send My Estimated Tax Payment 20222024 Form Fill Out and, Any money you get from. Solved•by turbotax•2195•updated january 30, 2024.

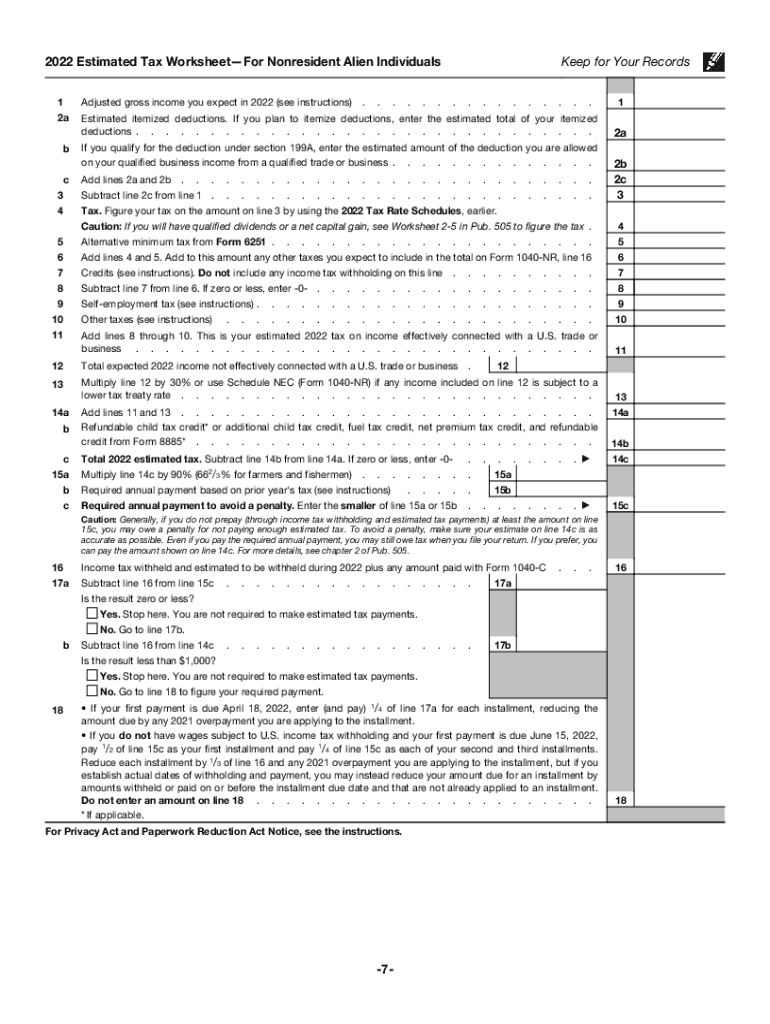

Source: sheelaghwbabara.pages.dev

Source: sheelaghwbabara.pages.dev

Estimated Quarterly Taxes 2024 Due Dates Schedule Dody Nadine, Calculate your upcoming quarterly tax payment, with this free tool for freelancers. Our home sale calculator estimates how much money you will make selling your home.

Source: michelinawsusy.pages.dev

Source: michelinawsusy.pages.dev

How To Estimate 2024 Tax Return Kelsi Melitta, You can pay your estimated taxes online through your irs account, the irs2go app, irs direct pay, or the electronic federal tax payment system (eftps). Sign in to make a tax deposit payment or schedule estimated payments with the electronic federal tax payment system (eftps) enrollment required to use.

Source: bobbettewcecily.pages.dev

Source: bobbettewcecily.pages.dev

W4 Form 2024 Instructions In Pavla Beverley, See what you need to know about estimated tax payments. There are four payment due dates in 2024 for estimated tax payments:

Source: www.taxuni.com

Source: www.taxuni.com

IRS Pay Estimated Taxes Online, An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. Updated on apr 24 2024.

Source: stormiewaudre.pages.dev

Source: stormiewaudre.pages.dev

Irs Tax Payment Schedule 2024 Elie Nicola, The types of taxes a deceased taxpayer's. From now on, all of your bank account types must be mentioned on your tax forms.

Source: www.youtube.com

Source: www.youtube.com

Estimated Tax Payments YouTube, Enter your filing status, income, deductions and credits and we will estimate your total taxes. In general, one must pay estimated taxes if they expect to owe at least $1,000 in tax (net of withholding and refundable credits) during the year.

Paying Your Estimated Taxes Can Be Done Through Several Methods:

Our home sale calculator estimates how much money you will make selling your home.

If You Get Medicare Earlier Than Age 65, You Won’t.

Payroll taxes, including federal insurance contribution act taxes.